When Did De-Dollarization Truly Begin to Bite? A Brief Timeline

The United States has always exuded power and prestige in all possible ways. The American currency was deemed the world reserve asset, which again delivered considerable strength to America, helping the nation in establishing global control while encountering a sense of domination over other nations. This development helped the US gain significant international momentum.

However, as times evolved, wobbly US fiscal policies, the USD weaponization, the sanctioning process, and tariffs have all contributed to the fall in USD value. The distilled version of it all gave birth to a de-dollarization, which, through decades, can be best explained as a form taking shape in gradual phases. However, there was this one catalyst that helped spread de-dollarization at a rapid pace, resulting in nations abandoning the US dollar more frequently and openly.

Also Read: Central Banks Buy 166t Gold as BRICS Pushes De-Dollarization Forward

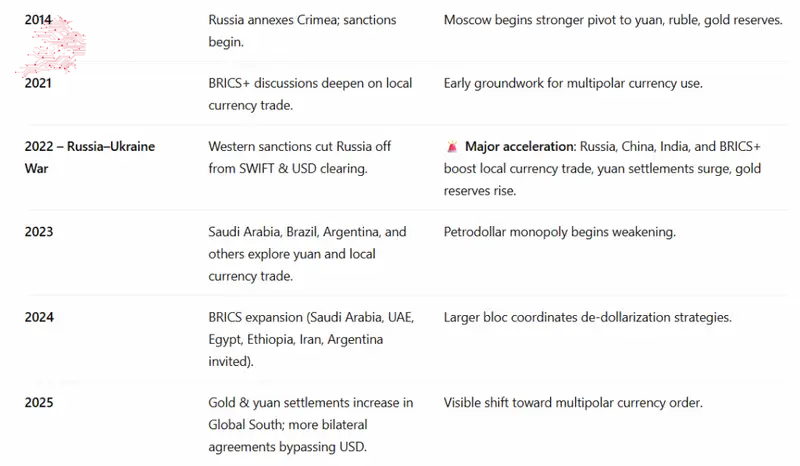

The Catalytic Timeline of De-Dollarization

The US dollar has always exhibited a strong value stance, despite the currency attracting significant price volatility. However, the currency derailment began in force around the 1990s and 2000s when the American authorities sanctioned Iraq and Iran, inviting global scrutiny and speculation.

The criticism invited was mainly centered around the US’s power to sanction nations. This could pose grave effects on the nations’ own independent economies. The topic of debate rose to new heights, arguing how the nations should figure out ways to stop relying on the US dollar as their sole surviving element. Moreover, the global crisis of 2008 also shook the world, nudging nations to adopt a cautious stance against the US dollar.

When Did It Truly Begin: The Moment Everything Went South

However, de-dollarization till now has still been a gradual development. The phenomenon caught pace after the Russia-Ukraine war, when the US sanctioned Russia, disabling the nation from accessing SWIFT.

This catalytic moment reverberated across, pushing a domino effect into motion. This resulted in Russia exploring local currencies for trade. This narrative was capable of stirring a new notion in others, pushing them to prioritize local currency surge rather than depending solely on the USD for trade purposes.

“However, some experts, including US Treasury Secretary Janet Yellen, say that the aggressive use of sanctions could threaten the dollar’s hegemony. (Other economists dispute this). “Sanctions are an effective tool, but we have to be careful,” CFR’s Benn Steil told NPR. “It’s like over-prescribing an effective antibiotic. It encourages the development of new strains of bacteria that are resistant to the antibiotic.” Following Russia’s invasion of Ukraine, an increasing number of countries. Including US partners such as India, have explored ways to continue trading with Russia that don’t involve the dollar. Meanwhile, the Chinese renminbi has become the most-traded currency in Russia.” As quoted in the Council of Foreign Relations Report

Also Read: J.P. Morgan: De-Dollarization Fuels Global Currency Drop Through 2026

Comments

Post a Comment