Is Crypto Activity Migrating Outside The U.S.?

Over the past few months, regulators in the United States have taken a host of enforcement actions against varioUS crypto bUSinesses. Last month, Ripple executive Brad GarlinghoUSe told Bloomberg that the SEC’s recent increase in crypto enforcement actions is keeping the U.S. behind other countries in terms of establishing productive crypto regulation. In fact, he has time and again also asserted that the crypto indUStry has already started moving Offshore.

Owing to the regulatory uncertainty, Coinbase, the largest U.S.-based crypto exchange, is parallelly looking to launch a trading desk outside the U.S. Alongside, Circle, issuer of the USDC stablecoin, is ramping up its European footprint and seeks to register in Paris. The company’s chief strategy officer asserted recently that, “France is increasingly seen as a leader in crypto.”

So, with crypto companies looking to establish their presence outside the U.S., it’d seem like crypto activity is also moving offshore. Well, looks like that’s not essentially the case.

The market share of U.S. volume has actually increased since the beginning of 2023, according to a recent Kaiko analysis. In 2020, for instance, offshore activity accounted for 90% of the total volume, while U.S. trade volume made up the remaining 10%. However now, U.S.’s share has inclined up to 14%, while the offshore volume has dropped to 86%.

Also Read – Bitcoin: WEF Video Showcases Mining, But Omits ‘B Word’

The East vs. West Banter

Chalking out the possible reasons, Clara Medalie, the Director of Research at Kaiko explained:

“– Huobi/Okex used to dominate offshore volumes, but post-China ban lost a huge amount of share which coincided with Binance’s rise

– Coinbase hasn’t had much growth

– Binance turned back on trading fees, causing U.S. exchanges to gain a bit since March“

At this stage, it is also interesting to note that the trader/investor interest is not especially high in other offshore countries. As analyzed in an article yesterday, the Korea Premium Index has been on a downtrend over the past few weeks, supporting the said narrative.

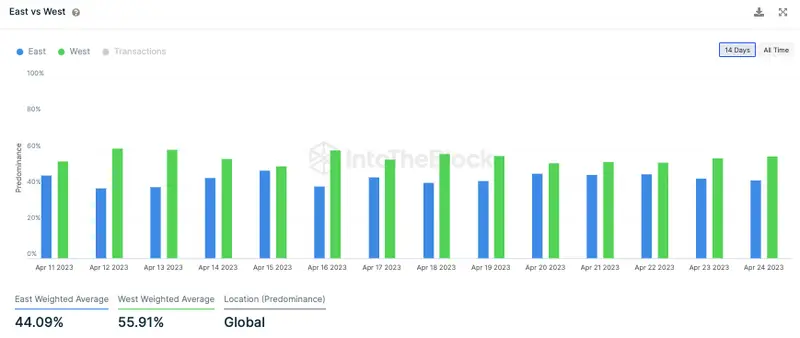

Furthermore, data from IntoTheBlock brought to light that the West continues to have an upper hand in terms of Bitcoin transactions registered. The 14-day weighted average of the East stood at 44.09%, while for the West, that number stood at an elevated 55.91%. Thus, it can be deduced that crypto activity in the U.S. ain’t disrupted at the moment.

Also Read – Bitcoin: Russia Becomes 2nd Largest Mining Hub, U.S. Tops List

Comments

Post a Comment