Bitcoin Layer-2, Stacks' Native Token Gained Over 130%, Why?

The Stack Network is a Bitcoin (BTC) layer-2 for smart contracts. The project aims to fully realize the programmability of the oldest blockchain in the world. Stack Network’s native token, STX, has surged 9.6% in the last 24 hours. Moreover, the token rallied by 135.7% in the monthly chart. The weeklong gains helped the coin reclaim its billion-dollar market valuation while also handing substantial rewards to short-term holders.

Stacks maintains its ledger to store information outside of the BTC blockchain. As a result, programmers can create applications that are similar to those on Ethereum and Solana. Additionally, STX is also known as the first token offering approved by the U.S. Securities and Exchange Commission (SEC).

Why is the Bitcoin layer-2 network’s token surging?

The increase in NFT network activity on the Stacks blockchain may have been one of the factors behind the current spike in STX. As investors seek out additional exposure to the NFTs-on-Bitcoin narrative, the excitement surrounding Ordinals, a recently announced Bitcoin-based NFT project, may have had a favorable effect on the network’s general activity.

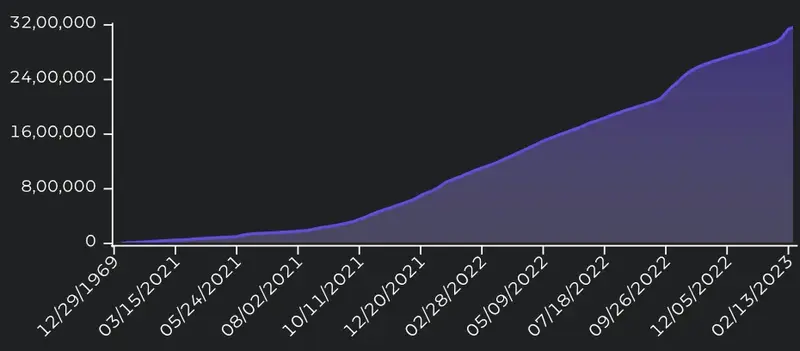

According to information from StacksonChain, the network handled 3.36 million transactions in February. When compared to the network’s 1.13 million transactions from the previous month, this is a 223% increase.

According to StacksonChain, the number of transactions on the Stacks network’s mempool increased during this time, demonstrating rising network demand. The mempool is a pending transaction queue, where they are stored until approved and added to the blockchain.

At press time, STX was trading at $0.646089, up 9.6% on the daily charts. However, the token is down by 80.94% from its all-time high of $3.39, attained on Dec. 1, 2021.

Comments

Post a Comment